Now that the Democratic and Republican presidential nominating conventons are over, we can not forget what the next President, whomever he is, will face: The treasury is going to need increased revenues while trying to assist lower paying workers with children.

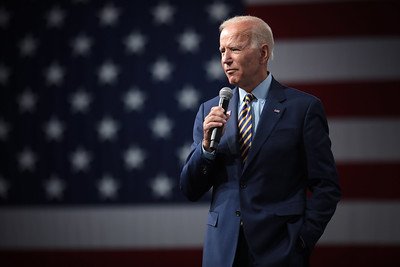

What’s Joe’s Bidens plan:

1- Hiking the corporate income tax.

Under his tax plan, the corporate tax rate would be increased to 28 percent — an almost 30 percent increase over the current rate.

Increasing the corporate tax rate to 28 percent, Biden believes will raise roughly $3.3 trillion to $3.7 trillion in estimated extra revenue over the next decade.

Biden’s plan also calls for hiking the minimum absolute business tax to 15 percent. There will be no more write-offs reducing corporate tax liability to zero percent, something Biden and others accuse mega-corporations, like Amazon, of doing.

2- A 50 percent increase in the off-shore corporate tax

Biden’s tax plan would also double the tax rate on Global Intangible Low-Tax Income earned by foreign subsidiaries of U.S. companies. Currently set at 10.5 percent, the GILTI tax rate would increase to 21 percent.

3- A new “financial risk” fee on banks

Biden believes that big banks should maintain Federal Deposit Insurance but that it should be paid and covered by banks, not government.

4- A 10 percent wealth tax

If you make over $500,000 a year, get ready to pay more in taxes. Biden would like to see America’s wealthiest earners open up their wallets. He’ll do this by re-raising the top marginal income-tax bracket from 37 percent to 39.6 percent.

5- A payroll tax for people making over $400,000.

Currently exempted from paying 12.4% Social Security tax, these high-income earners would see the tax reinstituted under Biden’s proposal.

6-Higher Captain Gains taxes

If you make $1 million , currently your Capital Gains rate is close to 40%.Under Bidens plan, that could go as high as 43%, or an 8% increase.

7-Limit itemized deductions

Itemized deductions, from medicial expenses to charity , would be capped at 28%. So if you are someone who normally falls into a tax bracket over 28%- youll actually lose more deductability.

8- Lower Small Business Deductions

If you make more than $400,000 in business earnings, you can expect your small business deductions to be phased out. This could be a loss( or a tax) of over 40%

9- Institute first-time homebuyers’ and renters’ tax credits

Biden talked up the idea of providing new homebuyers with a tax credit worth up to $15,000. Known as the First Down Payment Tax Credit, it would aid first-time homebuyers in covering the initial costs and fees associated with purchasing a home.

Additionally, Biden wants to provide Section 8 housing vouchers to eligible families so they won’t have to spend more than 30% of their income on rent.

10- More money for Child & Dependant care

Joe wants to increase , the allowability of extra monies for Child & Dependent care credits, from currently $2,100 to $8,000- a 74% increase .

So if you make under $100,000, have children or buying a home, you can get lower taxes , about 20%, down the Biden Plan road. If you make over $400,000 in income, own a business and handle foreign exchange, get ready to cough up an extra 80%.In between, what many would call the middle class, the change would be miniscule.

Follow Us